Image Sourece: Freepik

The past few years have been challenging for businesses, especially accounting firms in the U.S. following the pandemic and the Great Resignation in 2021; companies have been trying to find a firm footing and increase their productivity despite qualified and experienced professionals quitting the workforce. Many businesses handle accounting in-house, relying on a small team to assume various accounting roles, which inversely increases burnout. One issue is clear – hiring a certified accountant is becoming more complex but more critical than ever, and you need to understand why.

What does a Certified Accountant Do?

An accountant is not a side role when it comes to running a company. They have their hands on the jugular vein of your business, the financial flow. So understand the role of an accountant in your business and what they can do to improve your financial health.

Unlike a general accountant, a certified accountant holds a professional accounting certification like the CPA (Certified Public Accountant) or the CA (Chartered Accountant). They possess a higher level of expertise, undergo a rigorous training and learning process, and adhere to state and federal regulations to maintain a higher ethical standard in their practice.

Beyond Crunching Numbers – Underrated Benefits of Hiring a Certified Accountant

The global shift in financial practices demands accounting professionals to go beyond their usual tax preparation, financial reporting, and auditing roles. 79% of accountants say that client expectations have expanded to include the provision of business and finance consultancy. This expectation has pushed firms to look for diverse talent, with 42% of firms working actively to diversify their workforce. (Sage) Certified accountants provide these insights and capabilities to your business. Here is how:

Technology Integration

Many businesses still rely on paper-based, old processes to handle their accounting functions, which inevitably causes delays, errors, and increased workloads for their staff. Financial management now demands a more sophisticated infrastructure and increased reliance on technology.

Certified accountants utilize their advanced technical knowledge to incorporate accounting software and analytics to fast-track manual accounting processes and increase operational efficiency. Hire a certified accountant to transition legacy systems into modern and effective ones to save time and improve productivity.

Risk Mitigation

Where there is money, there is a risk, and businesses need to navigate through that risk to ensure financial success. Management alone cannot anticipate and control risk factors when making new investments or handling their finances. However, not having a skilled accountant on your team means a higher chance of small mistakes costing you a lot of money. While it’s not as pressing as some more significant challenges, according to Accountancy Age, 5% of individuals identified financial penalties as their worst accounting concern.

Hire a certified accountant to help you identify financial risks before they arise, such as cash flow shortages, fraud, and tax penalties. They use their analytical skills, advanced tools, and metrics to pinpoint common patterns of inefficiency or errors and help organizations rectify those mistakes to improve accuracy and mitigate financial risks. If you are hoping for greater profitability, leverage the accounting skills of certified professionals to your advantage.

Image Sourece: Freepik

Staff Augmentation

Financial processes can get overwhelming and tedious, especially if your team has limited time and capacity to cater to them adequately. One of the most common issues companies faces is the lack of specialized, dedicated talent handling large workloads, reducing errors, and speeding up internal financial processes. While the challenge stands, many firms rely on their in-house accounting teams to manage the work due to budgetary constraints or talent shortages to hire additional experts. But the tides are changing, as almost 59% of finance managers plan to augment their permanent teams with contracted experts in the second half of 2024.

The common perception is that IT industries use staff augmentation to increase operational efficiency. Still, it is fruitful for accounting firms to augment their in-house teams with affordable, certified accountant expertise to manage the workload, usually in the role of a senior accountant. Thanks to their advanced capabilities and industry knowledge, certified accountants can provide an overview of the firm’s financial processes, guide accounting teams to organize their workflows, and adopt innovative strategies for improved performance.

Succession Planning

Most business owners need help to properly and fairly hand over their business to successors or new management when they plan to retire or merge with another company. It’s a long process that requires acute attention to detail and proper documentation, and one of the most grueling processes in this is the transfer of assets and revenue to the rightful shareholders. Compared to other constant challenges of managing a business, succession planning is not a regular occurrence, so most companies don’t prepare for them. According to a report published by Deloitte, around 51% of leaders have weak confidence in maintaining clear and consistent succession programs.

While the challenge of succession planning is not entirely a financial issue, it is usually the biggest concern for companies. Appointing new management means operational shifts and increases the risk of turnover and revenue losses, which is where a CPA certified accountant can help make the transition smoother. They can critically value the business to determine a fair selling price and draft a profitable buy-out agreement. They can advise on tax implications of different succession strategies like transfer of ownership to family members, buying a business outright, or setting up an employee stock ownership plan. Succession can become complex, and hiring certified accounting and finance professionals eases the process and reduces ambiguities.

Image Sourece: Freepik

Implementing Ethics

Accounting departments handle confidential information like employee data, financial records, and tax processes. Adherence to a strict code of ethics is paramount to secure confidential information and protect the company’s assets and data. But that’s not all; accountants in the business sector face ethical dilemmas in issues like bribery, withholding information from auditors, or participation in fraudulent activity, regardless of the size of their work organization.

Hiring a certified accountant safeguards your business from such practices, as they adhere to a strict code of conduct developed by the International Ethics Standards Board for Accountants (IESBA). They self-regulate their behavior by following these codes and maintaining strict integrity to ensure ethical standards for their business. They maintain independence from their clients to remain objective and avoid prejudices and biases that affect their work. They support ethical standards by regularly reviewing peer reviews of their work by other professionals, taking regular training to advance their skills, and following disciplinary procedures to address ethical violations.

So, there you have the 5 underrated benefits of hiring a skilled, certified accountant. They can become significant assets to your business and help you manage operations with keen insights, so you make informed decisions. However, embracing the advantages of a certified accountant is only secondary to finding the right one for your business.

How to Hire a Certified Accountant

Despite the growing need for educated and experienced professionals, companies in the U.S. need help finding certified accountants for their business. As mentioned at the start of the article, a general lack of qualified talent and the swift departure of seasoned professionals from the industry has left accounting firms and other businesses worried about acquiring certified accountants for their business. In a recent survey by Thomson Reuters, 32% of respondents rate hiring and development of accounting talent as their highest priority. If you need help getting the right talent, let the right talent come to you with the help of a remote staffing agency.

Expert Staffing Solutions to Find Your Ideal Certified Accountant

Remote Scouts solves your talent shortages and skills requirements for top-notch certified accountants. We provide Employer of Record (EOR) services and tailored staffing solutions to scout certified accountants for companies that have exhausted all channels to find the ideal match. Save your recruitment time and rise above competitors to access top-tier certified accountant candidates without the hassle of hiring and onboarding.

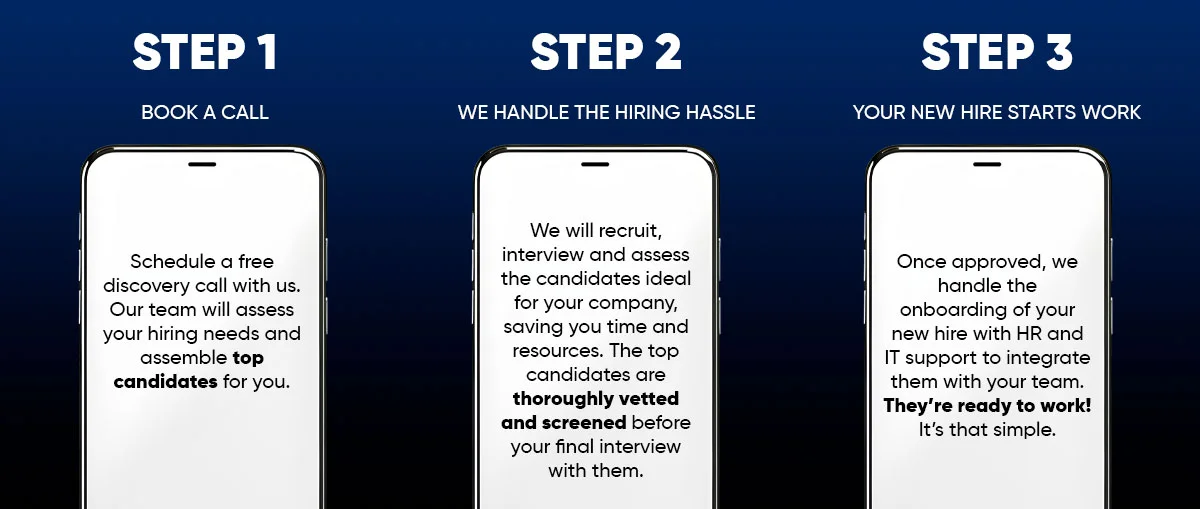

Here is how we make it possible for you:

- We are backed by 13 years of staffing experience, which we have distilled into tailored solutions to resolve your hiring needs.

- Our expertise spans onshore, offshore, and nearshore staffing, so we can hire a virtual bookkeeper, remote bookkeeper, or offshore bookkeeper to reduce your hiring costs by 40%.

- We will place your chosen certified accountant in a secure offshore but on-site facility to boost productivity and reduce overhead costs such as office placement, equipment, IT support, and onboarding.

- When looking for skilled bookkeepers, we tap inaccessible talent pools, leveraging the best talent available in up-and-coming markets to reduce your hiring time by 70%.

- As your Employer of Record, we go beyond hiring to provide HR functions, payroll, and compliance services to integrate and manage your chosen candidate within your company.

- We help you secure passive but ideal certified accountant talent that your competitors don’t know about. This will allow you to boost your financial management and profitability.

Hire a Certified Accountant in 3 Steps

Book a Call Now

Our Expertise Resolves Staffing Challenges for Industry Leaders

FAQs

What people are saying

Michael Stein, M.B.A

Michael Stein, M.B.A

Connection Marketing, Inc.

Finding high-level technical talent in digital marketing is always a challenge. Remote Scouts has solved that. They have been an invaluable partner for our business, providing top-tier digital marketing support across Meta, Google, and other platforms. Their team is not only highly skilled and dependable but has also integrated seamlessly with our company culture and processes. Their ability to adapt quickly and deliver consistently high-quality results has made them an essential part of our operations.

Michael Stein, M.B.A

Connection Marketing, Inc.

Lisa Rung

Lisa Rung

PFS Billing/Coding Manager

I want to express my strong recommendation for Remote Scouts, particularly for their exceptional medical billing staffing services. They consistently provided top-quality candidates for our medical billing needs promptly and have significantly improved our team’s capabilities. Their expertise, responsiveness, and dedication to results makes them an invaluable partner.

Lisa Rung

PFS Billing/Coding Manager

Glenwood Medical Associates

Billing Manager

I’ve had the pleasure of working with Remote Scouts for my staffing needs, and they’ve truly impressed me. Their personalized approach, top-notch candidates, and stellar communication set them apart. They deliver quality hires while staying within budget. If you need reliable staffing solutions, Remote Scouts is the way to go!

Nicole Jimenez

Billing Manager

Regain Medical Billing

Bejan Broukhim

Bejan Broukhim

CEO/President

I want to express my complete satisfaction with the services provided by Remote Scouts. I’ve worked with Remote Scouts to hire remote professionals for various roles within our organization. I’ve hired bookkeepers, and a social media marketer through Remote Scouts, and their performance has been extraordinary. They seamlessly integrated into our team, consistently delivering exceptional results.

Remote Scouts’ efficient recruitment process and commitment to finding the right talent have significantly helped us meet our business goals. We look forward to a long and productive partnership with them.

Bejan Broukhim

CEO/President

Nordic Plains, Inc.

Mark Steik

Mark Steik

General Collection Company, Inc.

We have been using their service for two months and are very happy with them. The collectors are very well-informed in collection law. Their employees are very professional and are hard working collectors. They stick to the task at hand. make calls and get money collected. I will recommend them to any collection agency. You will be happy with your results.

Mark Steik

General Collection Company, Inc.

Alan Fassonaki,

Alan Fassonaki,

CEO

Consistently impressed by the caliber of professionals introduced by Remote Scouts. We appreciate the diligence in selecting candidates who not only meet but exceed our expectations by consistently delivering high-quality legal talent.

Alan Fassonaki

CEO

Fassonaki Law Firm

Bejan Broukhim

Bejan Broukhim

CEO/President

I want to express my complete satisfaction with the services provided by Remote Scouts. I’ve worked with Remote Scouts to hire remote professionals for various roles within our organization. I’ve hired bookkeepers, and a social media marketer through Remote Scouts, and their performance has been extraordinary. They seamlessly integrated into our team, consistently delivering exceptional results.

Remote Scouts’ efficient recruitment process and commitment to finding the right talent have significantly helped us meet our business goals. We look forward to a long and productive partnership with them.

Bejan Broukhim

CEO/President

Nordic Plains, Inc.

Jonathan Hindes

Jonathan Hindes

Chief of Operations

It is my pleasure to recommend Remote Scouts for their services. I have worked with them closely during the transition of a handful of fully remote workers has been almost flawless. I have worked with other staffing agencies previously and I can state that, without a doubt, Remote Scouts has been the easiest I have ever done business with. Their training is very thorough, we have yet to see any of their representatives violate collections compliance. I would highly recommend them to anyone needing reliable staffing, quickly.

Jonathan Hindes

Chief of Operations

ACS Inc

Adam Pearlman,

Adam Pearlman,

COO

I am writing to endorse Remote Scouts and their exceptional staffing services. In my role as Chief Operating Officer at ARM Solutions, I have closely collaborated with Remote Scouts to meet our staffing needs, and I am pleased to attest to their consistent delivery of high-quality and professional services. Remote Scouts consistently provides top-tier candidates across various roles, including debt collectors, accounts receivables, sales & marketing, and more. Their extensive network and stringent vetting process ensure that the candidates presented not only meet but exceed our expectations, consistently setting a high standard of excellence. I strongly recommend Remote Scouts to any organization seeking staffing solutions.

Adam Pearlman

COO

A.R.M. Solutions