Image Source: Freepik

In recent times, the United States has seen an upward trajectory of debt, especially in credit card and auto loans, with rental and medical following suit. Creditors find themselves at the crossroads of balancing customer relationships and replenishing their bottom line. How do they manage that? Debt collectors. But what is a debt collector? They are finance specialists who use negotiation techniques, accounting software, and industry knowledge to retrieve your outstanding payments from consumers who owe your business money. All businesses need to keep their cash flow steady, and debt collectors make that happen with their efforts and expertise.

How Do Debt Collectors Work

As a business owner, you will most likely do business with your consumers on credit, and when you do, there will be instances where they will be late on payments or fall back on their outstanding invoices due to several factors. When that happens, most businesses reach out to debt collection companies or specialized debt collectors to recover their exceptional payments because they don’t have internal systems to recover that debt independently. If you want to know how debt collectors work to recover that amount, consider the challenges faced by businesses and the solutions these specialists present.

Prioritizing Consumer Interaction

All businesses must strive to retain their customers and foster positive relationships with them. In this situation, a debt collector’s duty is to become a bridge between the creditor and the consumer and establish a constant line of communication.

- They reach out to consumers with gentle reminders about their outstanding debt.

- They assess the consumer’s financial concerns to devise solutions to their challenges.

- They employ assertive but cordial communication with consumers to persuade them to pay.

- They empathize with the consumers and listen to their issues to make them feel heard.

Why is that important? Simply put, consumers want to feel supported and accepted. Despite the technological advancements introduced in customer service, especially automation and AI, a considerable 49% of consumers prefer to talk to a live agent when handling collection issues. Consumer interaction requires personalization and rapport building to sustain lifetime value, and that’s how debt collectors work. They try to gauge consumer challenges and devise practical solutions to preserve relationships.

Improving Cash Flow

There needs to be a steady stream of revenue from business sales. Customers who use goods or services on credit must be regularly reminded of their outstanding payments. Often, customer default on their payments, which causes significant strain on the cash flow, with limited resources left to invest in new projects and inventory. Business owners cannot maintain steady communication with every consumer and often lose track of accounts receivables. The pile is already too high when they realize the extent of their outstanding payments. What does a debt collector do in this situation?

They collaborate with accounts receivable specialists to gather timely updates on delinquent accounts and initiate communication with consumers to help repay their debt. Debt collectors know accounting principles and understand which accounts to prioritize to improve your cash flow immediately by targeting quick-to-engage customers and persuading them to repay their debt.

Resolving Manual Processes

There is more to debt collectors’ work than dialing calls and customer outreach. Companies often fall back on their receivables because they manually handle financial transactions and records. Even a company with an internal collection system will conduct manual email outreach or send letters without checking which consumer requires the most immediate communication.

Debt collectors with technical proficiency can adopt AI for intelligent debt collection strategies. They can use automation and AI predictive analysis to assess buyers’ creditworthiness before extending credit, reducing the risk of defaulting before it even begins. They can also help streamline collection processes by automating manual processes, digitizing communication, and scheduling contacts to speed up customer outreach.

Improving Creditworthiness

Consumers are not the only ones who benefit from creditworthiness. Businesses remain profitable with consistent lending power and can repay their debts on time. The average bad debt ratio for Fortune 1000 companies increased from 0.15% to 0.16%, indicating robust credit risk protocols and compelling accounts receivable processes that allowed them to maintain their bad debt ratio and collect effectively. Debt collectors associated with these firms or engaged by them manage this balance to ensure their business side steps the threat of bad debt.

How do debt collectors work to increase creditworthiness for businesses? When you hire a debt collection specialist, they use their strong negotiation skills and customer engagement techniques to engage harder-to-pay customers and unwilling customers to repay them to help reduce bad debt losses. The lower the ratio of bad debt a business has, the more likely it is to maintain its creditworthiness. Debt collectors also report positive metrics to credit bureaus to enhance a company’s credit score.

<h3>Improving Brand Integrity

There are long-term benefits to improving your debt collection practices that can speak directly to your reputation as a business. Imagine you have numerous outstanding payments by your customers, but you decide to collect internally to maintain control of your collections. Your internal staff is not trained in collection strategies and cracks under the pressure of dealing with all sorts of customers, eventually resorting to aggressive tactics to recover debt – who do you think this will hurt? The other side involves third-party collection agencies to handle your recovery but fielding the same kind of complaints from your customers about their litigious behavior. The balance is finding how a debt collector works to ensure cordial customer communication and strategic recovery.

Suppose you want to maintain brand integrity and reputation while collecting outstanding debts. In that case, the best solution is to hire a first-party debt collector. It’s the best way to use your brand image and voice, coupled with the industry experience of a debt collector, to recover the debt. They can focus on engaging customers before they become delinquent by using omnichannel communication, automated and timely contact, and diplomatic scripts to engage their customers. By utilizing your brand voice and image, first-party debt collectors can emulate the same customer experience that your brand provides while addressing the underlying concerns of debt recovery with your customers.

How do Debt Collectors Work Differently Offshore?

Among some of the significant trends in debt collection in 2024, companies emphasize the need for skilled debt collection talent to improve debt recovery strategies. Recruiting managers struggle to find debt collectors with specific industry knowledge and sufficient training to handle complex collection scenarios. Additionally, collection managers are contemplating moving collections offshore.

Despite the prevalent notion, offshore debt collection has gained more traction in recent years, with companies expanding their markets in different regions and developing strategies to handle collections on a larger scale. But why is it a favorable option?

- The cost-effectiveness of offshore talent for large companies enables high-volume hiring within tighter budgets.

- Offshore debt collectors’ cultural diversity and sensitivity allow creditors to communicate with diverse consumer bases.

- They have multilingual capabilities that help establish rapport with non-English speaking consumers.

- Unlike local collectors, offshore debt collectors are trained explicitly in local compliance laws, ensuring safer, cordial collection processes.

- International creditors find it challenging to navigate the complex political and social climate of offshore locations. Offshore debt collectors, however, have a nuanced understanding of the local landscape and can adapt collection strategies to streamline collections.

Source: Remote Scouts LinkedIn

How to Hire Offshore Debt Collectors

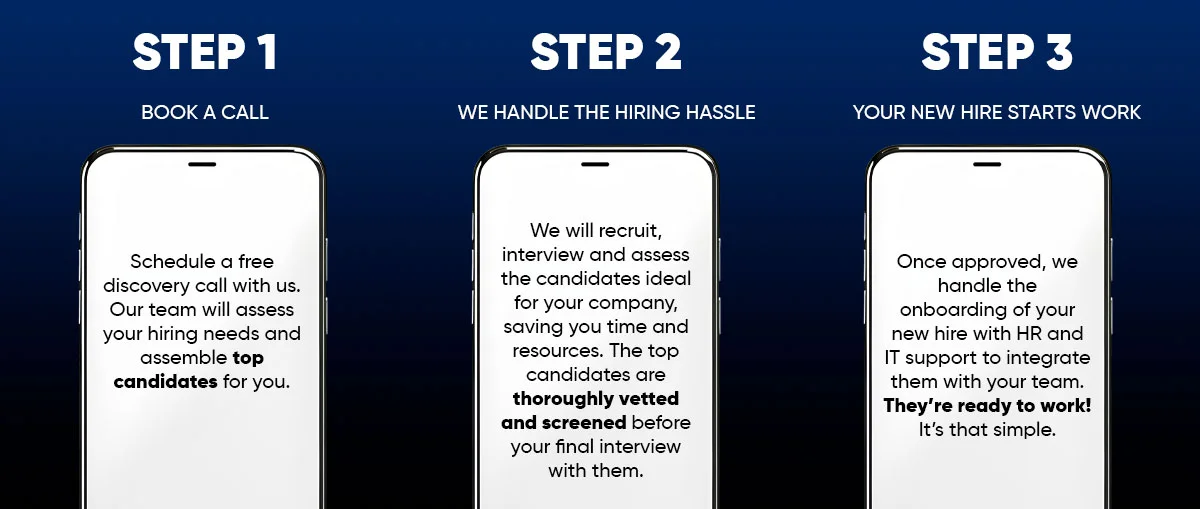

Suppose your business conducts international collections or plan to. In that case, the trepidation with hiring debt collectors in unchartered territory is justified, but there is a workaround. Partnering with a remote staffing agency can give you a competitive advantage in recruiting the best debt-collection talent offshore. You can count on their extensive network and robust screening processes to find specialized debt collectors that are harder to find on job boards. They tailor staffing solutions to your debt collector hiring needs and ensure you find specialists with industry experience to boost your debt recovery.

Remote Scouts is your key to hiring offshore debt collectors. As a reputable remote staffing agency and Employer of Record (EOR), our extensive talent pool has access to trained debt collectors ready to join your company at the drop of a hat. We source specialized debt collectors to handle your high-stakes collection processes and reduce bad debt to improve your cash flow.

Here is why we can hire a debt collector best suited to your needs:

- We are backed by 13 years of staffing experience, which we have distilled into tailored solutions to resolve your hiring needs.

- We leverage the experience of our parent company, Cedar Financial, a frontrunner in the collection business for the last 31 years. Our debt collector talent pool is mainly trained by the Cedar University training program, which instills compliance, problem-solving, and a people-focused approach to handling debt recovery expertly.

- Our expertise spans onshore, offshore, and nearshore staffing, so we can hire a debt collector offshore or nearshore to reduce labor costs by 40%.

- As your Employer of Record, we go beyond hiring to provide HR functions, payroll, and compliance services to integrate and manage your chosen candidate within your company.

- To address your data security concerns, we place your chosen debt collector in a secure offshore but on-site facility guided by SOC II Type II compliance certification to safeguard your sensitive data and conduct collections with complete professionalism and integrity.

Ready to Hire High-Performing Debt Collectors? Here’s How You Do It

Industry Leaders Trust Our Staffing Solutions

FAQs

What people are saying

Michael Stein, M.B.A

Michael Stein, M.B.A

Connection Marketing, Inc.

Finding high-level technical talent in digital marketing is always a challenge. Remote Scouts has solved that. They have been an invaluable partner for our business, providing top-tier digital marketing support across Meta, Google, and other platforms. Their team is not only highly skilled and dependable but has also integrated seamlessly with our company culture and processes. Their ability to adapt quickly and deliver consistently high-quality results has made them an essential part of our operations.

Michael Stein, M.B.A

Connection Marketing, Inc.

Lisa Rung

Lisa Rung

PFS Billing/Coding Manager

I want to express my strong recommendation for Remote Scouts, particularly for their exceptional medical billing staffing services. They consistently provided top-quality candidates for our medical billing needs promptly and have significantly improved our team’s capabilities. Their expertise, responsiveness, and dedication to results makes them an invaluable partner.

Lisa Rung

PFS Billing/Coding Manager

Glenwood Medical Associates

Billing Manager

I’ve had the pleasure of working with Remote Scouts for my staffing needs, and they’ve truly impressed me. Their personalized approach, top-notch candidates, and stellar communication set them apart. They deliver quality hires while staying within budget. If you need reliable staffing solutions, Remote Scouts is the way to go!

Nicole Jimenez

Billing Manager

Regain Medical Billing

Bejan Broukhim

Bejan Broukhim

CEO/President

I want to express my complete satisfaction with the services provided by Remote Scouts. I’ve worked with Remote Scouts to hire remote professionals for various roles within our organization. I’ve hired bookkeepers, and a social media marketer through Remote Scouts, and their performance has been extraordinary. They seamlessly integrated into our team, consistently delivering exceptional results.

Remote Scouts’ efficient recruitment process and commitment to finding the right talent have significantly helped us meet our business goals. We look forward to a long and productive partnership with them.

Bejan Broukhim

CEO/President

Nordic Plains, Inc.

Mark Steik

Mark Steik

General Collection Company, Inc.

We have been using their service for two months and are very happy with them. The collectors are very well-informed in collection law. Their employees are very professional and are hard working collectors. They stick to the task at hand. make calls and get money collected. I will recommend them to any collection agency. You will be happy with your results.

Mark Steik

General Collection Company, Inc.

Alan Fassonaki,

Alan Fassonaki,

CEO

Consistently impressed by the caliber of professionals introduced by Remote Scouts. We appreciate the diligence in selecting candidates who not only meet but exceed our expectations by consistently delivering high-quality legal talent.

Alan Fassonaki

CEO

Fassonaki Law Firm

Bejan Broukhim

Bejan Broukhim

CEO/President

I want to express my complete satisfaction with the services provided by Remote Scouts. I’ve worked with Remote Scouts to hire remote professionals for various roles within our organization. I’ve hired bookkeepers, and a social media marketer through Remote Scouts, and their performance has been extraordinary. They seamlessly integrated into our team, consistently delivering exceptional results.

Remote Scouts’ efficient recruitment process and commitment to finding the right talent have significantly helped us meet our business goals. We look forward to a long and productive partnership with them.

Bejan Broukhim

CEO/President

Nordic Plains, Inc.

Jonathan Hindes

Jonathan Hindes

Chief of Operations

It is my pleasure to recommend Remote Scouts for their services. I have worked with them closely during the transition of a handful of fully remote workers has been almost flawless. I have worked with other staffing agencies previously and I can state that, without a doubt, Remote Scouts has been the easiest I have ever done business with. Their training is very thorough, we have yet to see any of their representatives violate collections compliance. I would highly recommend them to anyone needing reliable staffing, quickly.

Jonathan Hindes

Chief of Operations

ACS Inc

Adam Pearlman,

Adam Pearlman,

COO

I am writing to endorse Remote Scouts and their exceptional staffing services. In my role as Chief Operating Officer at ARM Solutions, I have closely collaborated with Remote Scouts to meet our staffing needs, and I am pleased to attest to their consistent delivery of high-quality and professional services. Remote Scouts consistently provides top-tier candidates across various roles, including debt collectors, accounts receivables, sales & marketing, and more. Their extensive network and stringent vetting process ensure that the candidates presented not only meet but exceed our expectations, consistently setting a high standard of excellence. I strongly recommend Remote Scouts to any organization seeking staffing solutions.

Adam Pearlman

COO

A.R.M. Solutions