Image Sourece: Freepik

It takes a village to run a business. Every employee must play a specific role in making your business profitable. Your finance and accounting team is primarily responsible for growing your revenue and keeping financial matters in check to reduce risk, and bookkeepers play an essential role in that process. So, if you thought you didn’t need to hire a bookkeeper before, think again. Here are 5 ways hiring a bookkeeper grows your profitability.

What Do Bookkeepers Do?

When hiring them to utilize their skills fully, you must understand everything you need to know about bookkeepers. If you find a bookkeeper worth your while, they can add value to your business and help you successfully align your financial management and business strategy.

They watch your cash flow like a hawk and oversee recording all transactions, managing accounts receivable and payable, handling payroll, reconciling accounts, and preparing financial reports. These functions are the daily grind, but hiring a bookkeeper means using their insights and specific skills to positively impact your financial outcomes in lesser-known ways – let’s get into it.

Cost Reduction and Financial Analysis

Businesses have multiple revenue streams and transactions running simultaneously. Bookkeepers go beyond reporting to analyze financial data and pinpoint specific revenue leaks, wasteful expenses, and excessive spending.

Hiring a bookkeeper allows you to maintain cordial relationships with suppliers and vendors to keep payments flowing. They help negotiate better, more favorable deals with them to boost cash flow and save you money. They streamline financial workflows to reduce costs and find more efficient suppliers to keep your products and services accessible and sellable.

Financial Forecasting

Data is a bookkeeper’s best friend. They use historical data to analyze trends and patterns, identify high sales spikes, and forecast future performance. Measuring historical data is part of how bookkeepers pinpoint potential risks and opportunities in advance.

25% of accounting professionals must gain the knowledge or skills to use data more effectively. Hiring a bookkeeper boosts your financial planning, as they help you avoid pitfalls and prepare for any economic shocks that might come. They use their insights to develop robust financial plans to achieve business goals in the future and increase your profitability.

Image Sourece: Freepik

Inventory Management

It is common for businesses to overestimate the amount of inventory they need to meet product demand. This is a recurring issue, especially for retailers and other manufacturers, and the result is a stockpile of merchandise or products that are recalled or sold cheaper than expected.

Bookkeepers can save you money by optimizing stock levels, tracking inventory and sales data to measure demand and adjust supplies accurately. They also keep track of slow-moving items that don’t sell well, so you can adjust the inventory strategy to reduce and save production costs. Hiring a bookkeeper with industry-specific knowledge to analyze purchase trends and guide you on product development creates more sellable items to boost your sales.

Fraud Detection

Businesses often deal with fraudulent activities that can cause severe blows to their bottom line. According to accounting fraud estimates provided by ACFE, around 3.6 billion are lost to fraud worldwide. You need accurate checks to ensure every payment made to vendors and suppliers is recorded, and the right amount is paid to avoid fraud and revenue loss. Customers also make fraudulent transactions that can cause further issues.

If you hire a qualified bookkeeper to handle your transactions, they can use software and financial data patterns to detect signs of fraud by identifying any anomalies or inconsistencies. They can also help you establish internal controls to protect your business assets, prevent fraudulent activities, and secure your bottom line.

Strategic Planning

Growth is a significant factor in profitability in the physical and financial sense. Businesses prosper by actively thinking about expanding their operations, developing new products, and bringing fresh talent aboard. To make any of those moves, it is essential to have a clear picture of your finances, and that’s what bookkeepers do.

They assess your financial standing, such as historical records and partnerships, to provide insights into strategic planning. Guiding you where and when to invest is how bookkeepers skyrocket your business into new vistas. Businesses invest in opportunities that foster their growth and improve operations. Hiring a bookkeeper who identifies profitable investments like technology, human capital, and new markets improves company procedures. Almost 74% of accounting and bookkeeping professionals examined their company procedures last year to devise practices to sustain a business for the next ten years.

How to Hire a Bookkeeper for Your Business Needs

Image Sourece: Freepik

While there are 174,600 openings for accountants and bookkeepers in the U.S., filling those positions is becoming a significant challenge. Firms everywhere struggle to find candidates that match their needs, and the search for top talent continues. Partner with a staffing agency that can help you find a bookkeeper instead of draining your resources in searching for one.

Why is that a better alternative? Accounting and bookkeeping are no longer a number-oriented game. As established above, bookkeepers are evolving to assume more active roles in business operations, and companies are also encouraging this. Not only do 82% of accounting businesses want applicants with unconventional backgrounds, but almost 43% of companies are searching for employees with expertise outside of accounting.

So, if you use your internal talent acquisition and hiring teams, hiring a bookkeeper with diverse experience will be lengthy and taxing. Partnering with a staffing agency allows you to leverage their extensive network, diverse talent pool, and staffing solutions to recruit and hire skilled, results-driven, and insightful bookkeepers.

Remote Scouts – Your Gateway to Hiring a Bookkeeper Efficiently

The search for talent continues in the business world and skilled individuals are few and far between, especially ones with transferrable skills that can enhance business profitability with their diverse experience. Remote Scouts delivers Employer of Record (EOR) services and staffing solutions to companies that want to hire a bookkeeper while reducing costs.

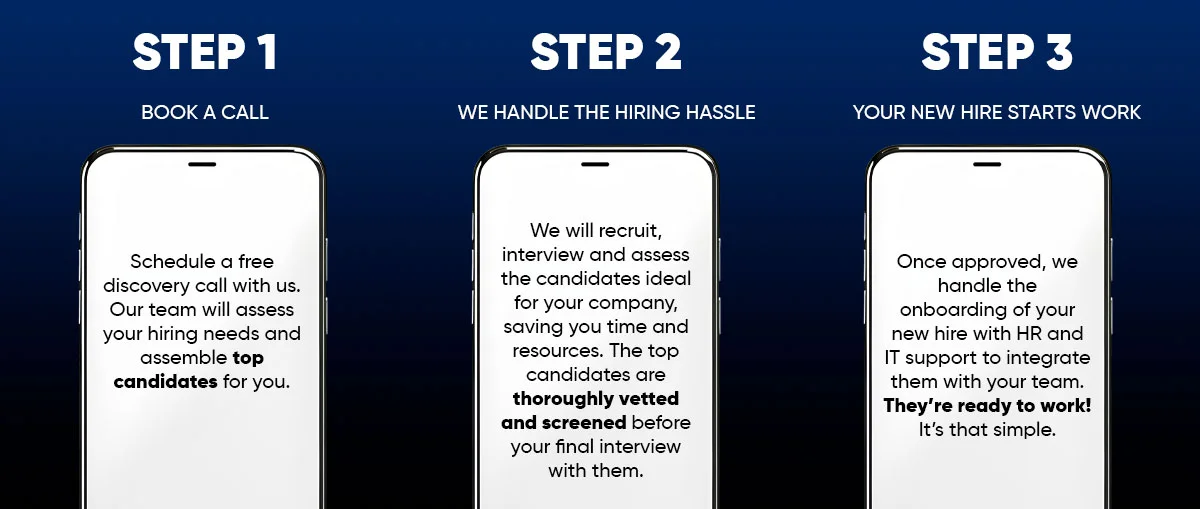

How can we hire bookkeeper talent for you:

- We are backed by 13 years of staffing experience, which we have distilled into tailored solutions to resolve your hiring needs.

- Our expertise spans onshore, offshore, and nearshore staffing, so we can hire a virtual bookkeeper, remote bookkeeper, or offshore bookkeeper to reduce your hiring costs by 40%.

- We place your chosen bookkeeper within a secure offshore but on-site facility to boost productivity and cut down on overhead costs such as office placement, equipment, IT support, and onboarding.

- We tap talent pools that are inaccessible when looking for skilled bookkeepers, leveraging the best talent available in up-and-coming markets to reduce your hiring time by 70%.

- As your Employer of Record, we go beyond hiring to provide HR functions, payroll, and compliance services to integrate and manage your chosen candidate within your company.

- We conduct robust screening processes for each candidate, including bookkeeper interview questions, skill tests, and behavioral assessments, to find the bookkeeper best suited for your company.

- We help you secure passive but qualified bookkeeper talent that your competitors need to learn about. This will allow you to expand into new markets and increase your profits.

Here Is How We Resolve Your Hiring Struggle

Our Expertise Resolves Staffing Challenges for Industry Leaders

FAQs

What people are saying

Michael Stein, M.B.A

Michael Stein, M.B.A

Connection Marketing, Inc.

Finding high-level technical talent in digital marketing is always a challenge. Remote Scouts has solved that. They have been an invaluable partner for our business, providing top-tier digital marketing support across Meta, Google, and other platforms. Their team is not only highly skilled and dependable but has also integrated seamlessly with our company culture and processes. Their ability to adapt quickly and deliver consistently high-quality results has made them an essential part of our operations.

Michael Stein, M.B.A

Connection Marketing, Inc.

Lisa Rung

Lisa Rung

PFS Billing/Coding Manager

I want to express my strong recommendation for Remote Scouts, particularly for their exceptional medical billing staffing services. They consistently provided top-quality candidates for our medical billing needs promptly and have significantly improved our team’s capabilities. Their expertise, responsiveness, and dedication to results makes them an invaluable partner.

Lisa Rung

PFS Billing/Coding Manager

Glenwood Medical Associates

Billing Manager

I’ve had the pleasure of working with Remote Scouts for my staffing needs, and they’ve truly impressed me. Their personalized approach, top-notch candidates, and stellar communication set them apart. They deliver quality hires while staying within budget. If you need reliable staffing solutions, Remote Scouts is the way to go!

Nicole Jimenez

Billing Manager

Regain Medical Billing

Bejan Broukhim

Bejan Broukhim

CEO/President

I want to express my complete satisfaction with the services provided by Remote Scouts. I’ve worked with Remote Scouts to hire remote professionals for various roles within our organization. I’ve hired bookkeepers, and a social media marketer through Remote Scouts, and their performance has been extraordinary. They seamlessly integrated into our team, consistently delivering exceptional results.

Remote Scouts’ efficient recruitment process and commitment to finding the right talent have significantly helped us meet our business goals. We look forward to a long and productive partnership with them.

Bejan Broukhim

CEO/President

Nordic Plains, Inc.

Mark Steik

Mark Steik

General Collection Company, Inc.

We have been using their service for two months and are very happy with them. The collectors are very well-informed in collection law. Their employees are very professional and are hard working collectors. They stick to the task at hand. make calls and get money collected. I will recommend them to any collection agency. You will be happy with your results.

Mark Steik

General Collection Company, Inc.

Alan Fassonaki,

Alan Fassonaki,

CEO

Consistently impressed by the caliber of professionals introduced by Remote Scouts. We appreciate the diligence in selecting candidates who not only meet but exceed our expectations by consistently delivering high-quality legal talent.

Alan Fassonaki

CEO

Fassonaki Law Firm

Bejan Broukhim

Bejan Broukhim

CEO/President

I want to express my complete satisfaction with the services provided by Remote Scouts. I’ve worked with Remote Scouts to hire remote professionals for various roles within our organization. I’ve hired bookkeepers, and a social media marketer through Remote Scouts, and their performance has been extraordinary. They seamlessly integrated into our team, consistently delivering exceptional results.

Remote Scouts’ efficient recruitment process and commitment to finding the right talent have significantly helped us meet our business goals. We look forward to a long and productive partnership with them.

Bejan Broukhim

CEO/President

Nordic Plains, Inc.

Jonathan Hindes

Jonathan Hindes

Chief of Operations

It is my pleasure to recommend Remote Scouts for their services. I have worked with them closely during the transition of a handful of fully remote workers has been almost flawless. I have worked with other staffing agencies previously and I can state that, without a doubt, Remote Scouts has been the easiest I have ever done business with. Their training is very thorough, we have yet to see any of their representatives violate collections compliance. I would highly recommend them to anyone needing reliable staffing, quickly.

Jonathan Hindes

Chief of Operations

ACS Inc

Adam Pearlman,

Adam Pearlman,

COO

I am writing to endorse Remote Scouts and their exceptional staffing services. In my role as Chief Operating Officer at ARM Solutions, I have closely collaborated with Remote Scouts to meet our staffing needs, and I am pleased to attest to their consistent delivery of high-quality and professional services. Remote Scouts consistently provides top-tier candidates across various roles, including debt collectors, accounts receivables, sales & marketing, and more. Their extensive network and stringent vetting process ensure that the candidates presented not only meet but exceed our expectations, consistently setting a high standard of excellence. I strongly recommend Remote Scouts to any organization seeking staffing solutions.

Adam Pearlman

COO

A.R.M. Solutions