Collections are a tightrope of a business where you always must walk the line of maintaining positive customer relationships and recovering unpaid due for your clients, without losing balance on either side. In this situation, only the most battle-trained people can survive and hold their own to perform debt collector duties diligently and proficiently. The debt collection industry generates around $13 billion annually, which means there is a growing need for skilled debt collectors across the U.S. There is an entire range of job responsibilities that debt collectors have, and they need to be on top of their game to ensure their collection strategies are cordial, effective, and persistent. But what exactly entail being a debt collector? Let us dive in and find out what debt collectors do and how they fulfill their roles in a debt collection agency.

Debt Collector Roles and Key Responsibilities

There are two types of debt collectors, a person affiliated or working for a collection agency and a freelance debt collector who works on commission for various organizations to collect their outstanding accounts. Debt collectors are the primary point of contact that helps recover unpaid dues from businesses and consumers on their outstanding balances. Any amount that a business or person owes to a company or business is the responsibility of a debt collector to retrieve for a collection agency. Here is a basic debt collector’s duties description for anyone who is not familiar with their process and their exact responsibilities.

Communicating with Consumers and Borrowers

One of the primary responsibilities of a debt collector is to handle client-facing issues. They are the ones who make the calls to consumers and customers, and they listen to their issues and devise strategies to retrieve and recover unpaid debt as swiftly and efficaciously as possible. Debt collectors use all sorts of communication channels such as emails, SMS, and phone calls to connect with consumers or borrowers to request payments owed to the business or organization they work for. In some cases where a collection process lingers for a more delinquent debt, the responsibilities of a debt collector can also extend to face-to-face visits or home visits to persuade non-paying parties to settle their debt.

Negotiating Payment Terms

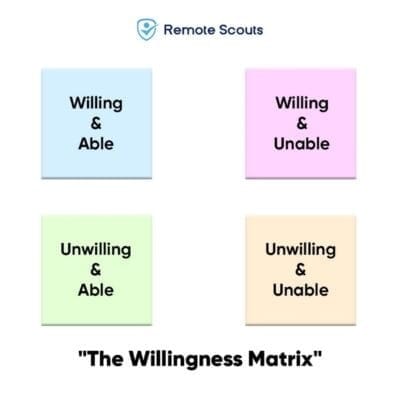

The second most demanding duties of a debt collector are to negotiate payment plans and flexible payment terms with borrowers. A recurrent and common challenge that debt collectors handle is to listen to borrowers and figure out how to create payment plans that suit the borrower’s financial situation and ability and willingness to pay. To get the desired amount paid by the consumer, most debt collectors utilize what we call the Willingness matrix. There are four kinds of borrowers and each of them exhibits a certain willingness, or lack of, to pay their debt. The matrix goes something like this:

- Willing and Able – Borrowers who are willing to pay their debt and able to but need a reminder or gentle nudge to do so.

- Willing and Unable – Borrowers who are willing to pay their debt but have been held back by sudden expenses or financial hardship.

- Unwilling and Able – Borrowers that can pay their debt but have most likely disputed their claim or are dissatisfied with the process of collection.

- Unwilling and Unable – Borrowers that are neither capable of paying their debt nor are willing to pay due to a dispute on a claim or dissatisfaction with the collection process.

Between these four categories, you find all kinds of borrowers that debt collectors communicate with and figure out which person is in which section. According to their intent and ability to pay, each debt collector outlines the collections strategy they need to encourage these borrowers to pay their unpaid balances and recover their debt.

For borrowers that are willing to pay or those that are willing but might have some financial issues are easier to communicate and negotiate with, because they mostly need a gentle reminder or a straightforward solution to their payment process to straighten out their debt recovery. For borrowers that have a history of disputing claims or refusing to pay over various issues is usually harder to persuade. Debt collectors must ensure that they communicate empathetically, and cordially but assertively with these borrowers to familiarize them with the consequences of non-payment and the fear of impending debt and default. These borrowers usually dispute claims quite regularly or will produce various excuses to not pay and need more persuasive tactics to pay their outstanding debt. Seasoned debt collectors develop communication strategies, negotiation techniques, and various sales techniques to convince them to pay their debt.

Handling Disputes and Inquiries

It is up to the debt collectors as part of their duties to ensure they communicate all relevant information regarding the debt to the borrowers. They are responsible for explaining all the terms of the debt as well as any inquiries that the borrowers have regarding their outstanding balance and the payment plans to ensure borrowers are well-informed and cognizant of their obligations towards the business or person, to which they owe the debt. They investigate discrepancies, resolve any disputes amicably, and provide the accurate information that the borrowers need.

Documenting Communication

Debt collection is a tricky business that requires record-keeping and proper documentation of every process. Not only is the process long and strenuous, but it is also rife with confidential information that can be exploited in the wrong hands, so privacy and confidentiality are of utmost importance. Debt collectors work closely with accounts executives and accountants to handle the borrower’s confidential financial information and need to ensure they follow the strictest security and privacy protocols to ensure data security. Each step and communication had to be documented so it could be shared in case of a dispute or litigation.

Assisting Legal Counsel

Most debt collectors must work with legal counsel and case managers during litigation against borrowers who refuse to pay or in the case of extremely delinquent accounts that have gone to judgment. Debt collectors follow protocols to document every process of debt recovery and they are an important asset to the legal team in cases of litigation and judgment on any borrowers.

Types of Debt Collectors and Their Responsibilities

Debt collectors are highly sought-after in almost every sector. They are especially connected to all kinds of businesses that have any transactional aspect attached to them like retail, commercial businesses, education sectors, government bodies, and medical organizations. All these various businesses and organizations have some form of relationship with consumers or service receivers that must pay fines, fees, taxes, loans, or other forms of contractual obligations on the services or products they consume.

Two kinds of debt collectors work in these various kinds of sectors: commercial debt collectors and consumer debt collectors. Commercial debt collectors usually do debt collection for businesses that have accounts receivable with other businesses and need to recover that debt around businesses, goods, or property. Commercial debt collectors recover money from individuals who owe student loans, auto loans, medical bills, and credit card debt.

What Makes a Good Debt Collector

As iterated earlier, debt collection is not a breezy business; it takes a strong person to withstand the changing winds of collections and go along with them to find a solution for situations on the go. Debt collectors must have strong financial backgrounds and any added experience in finance or sales is a plus point to ensure they can communicate and connect with all kinds of borrowers and organizations to establish a relationship of trust.

Find out why Pakistani Debt Collectors are Changing the Game

The key attributes of debt collectors also include effective communication skills, including listening skills to ensure they can connect with borrowers when conducting outreach. They need to create a rapport with every person they talk to so they can build trust with the consumers. Another viable attribute for debt collectors is to maintain compliance and regulations. Collections involve handling sensitive financial and consumer data which means following strict security protocols. Additionally, each state has its own set of compliance laws and regulations to ensure that collection processes are legit and ethical and there is no room for harassment, aggressive tactics, or fear inflicted upon consumers to collect debt. Maintaining compliance is a must-have for all debt collectors and they need to ensure they follow all the regulations that are implemented in debt collection FDCPA, FCRA, TCPA, UDAAP, AND HIPAA, among others. These laws are in place to safeguard the rights of consumers and create an ethical precedent for collection agencies to follow in their debt collection process.

Offshore Debt Collectors and their Superpowers!

Now, let us talk a little about debt collection on a global scale and the role and duties of debt collectors in that area. While collections are a tricky business when it comes to navigating various compliance issues, a seasoned collector can work from anywhere and with all kinds of companies without fail. Many companies are feeling the void of great debt collectors in their domestic workforce and are heading offshore for their debt collection needs. This shift in the debt collection hiring processes is mainly because of a lack of qualified talent locally, which is pushing many companies to explore debt collection specialists offshore.

Follow Remote Scouts LinkedIn for updates on our offshore hiring processes.

Unlike your domestic debt collector, the collection specialists you hire offshore have a few advantages. Not only are offshore debt collectors cost-effective for collection agencies because they save a significant amount of money hiring someone offshore with the same and even better competencies, but they also get better talent. You can find a college graduate with great comprehensive skills in the same and even less cost than you would in the U.S. for debt collection, who are available around the clock and can work in tandem with various time zones.

Offshore debt collectors work with a host of different companies, which allows them to build a wider perspective on debt collection than their local counterparts. In addition to that, communication is an important aspect of collections and offshore debt collectors are bilingual, which allows them to engage with a larger population of consumers. With language barriers overcome, bilingual offshore and nearshore debt collectors can become great assets to collection companies and help scale their business to new avenues.

Remote Scouts – The Ultimate Hub for Debt Collection Talent

You can look far and wide for the best debt collection talent but you won’t find the expertise and experience that is brought to you by Remote Scouts. With over a decade of experience in offshore and nearshore staffing, we rally the best and brightest of the debt collection pool and match their competencies to your business to give you the maximum advantage out of your offshore talent acquisition process. We have a thorough screening process that gauges every debt collector before they are selected to be interviewed with you, and with a secure facility situated in Pakistan, we provide a secure location for your debt collectors to work with, while seamlessly integrating with your team with quality infrastructure for remote work. Every step of your onboarding process is managed and supervised, and we guarantee that every debt collector hired by us for you can begin to generate value for you as soon as they are integrated to augment your collection process. So, if you are looking for a debt collector who fulfills their duties and generates revenue for your business, look no further than Remote Scouts!