Image Source: Freepik

The strength of a thriving business is to keep its cash flow running and avoid financial mistakes that can hurt its growth. You need to hire an accountant to keep an eye on your finances and bring you back when you get too close to the edge. The next question is a common fear for business owners; “how much does it cost to hire an accountant? And will that hurt my bottom line?”. The short answer is no. An accountant provides financial advice and data-driven insights to ensure you know exactly how your business makes and loses money; something software can’t anticipate. Hiring an accountant is a safe and profitable decision in the long run.

The Average Cost to Hire an Accountant

In the U.S., the average cost of an accountant can range from $37 to $100, depending on the breadth of services they offer. Don’t gasp yet; you can quickly assess your business needs and decide whether you need a full-time accountant, or you can streamline your financial matters with a bookkeeper instead. Before you hire an expert, here’s everything you need to know about bookkeeping and accounting to understand the difference between the two and decide who suits your business needs more.

Not all businesses are the same; some accounting expertise is more than others, like retail and e-commerce businesses. The size of your business also determines the level of knowledge you need. If you are a small business or a startup, spending a high cost to hire an account is not feasible for you. Luckily, there are various staffing solutions to hire an accountant with diverse capabilities to master financial challenges.

When do I Hire an Accountant For My Business?

There are usually tell-tale signs that you need to hire an accountant, especially if you are spending more money than you are making. This situation indicates two things:

- You’re handling their basic accounting needs with accounting software.

- You’re not using financial data to analyze their expenses and make careful spending decisions.

These two significant signs mean you should hire an accountant because your business suffers due to a lack of due diligence and dedicated time to analyze your finances.

There are also other reasons you should consider hiring an accountant.

- Do you spend more time handling bookkeeping tasks and balance sheets than you would care to admit?

- Are you facing business losses due to incorrect financial transaction records?

- Have you been penalized for tax errors or failure to comply with regulations?

- Is accounting simply another task you get to when you have the time in your pipeline?

- Do you get overwhelmed with the increased accounting and tax preparation workload during tax season?

If the answer to any or all the questions above is yes, you should consider hiring an accounting professional with the relevant financial management experience you require. Based on your specific need, you can choose whether to hire an expert bookkeeper or reap the benefits of hiring a certified accountant instead.

How Much Does It Cost To Hire An Accountant Near Me?

Based on the location of your business, you can hire an accountant for $150/hr to $400/hr. You will get different rates in different states, so conduct some market research, consult with other business networks on a suitable accountant cost for you and field different candidates to find the one that suits your business needs and your budget.

There is a downside to hiring an accountant in-house or from within your area. In the first case, you must bear the cost of employment, office placement, software and hardware, employee benefits and compensation, and training and development. The cost to hire an accountant with certifications, or a CA, will be higher due to immense demand and limited candidates.

The second case is hiring within a limited talent pool. If you hire an accountant based on your location, you run the risk of ending up with the same kind of professionals who have basic accounting or bookkeeping experience but don’t align with your business needs.

There is a workaround. You can access a diverse and highly skilled talent pool of accountants if you expand your horizons and hire an accountant offshore.

Image Source: Freepik

Why Should I Hire an Offshore Accountant?

Businesses still resist moving any part of their operations away from their in-house teams. Handing accounting services to a third party or offshore expert is not new, but it still raises eyebrows. We’ll put your mind at ease.

Hiring an accountant offshore or nearshore doesn’t mean compromising your financial data security or settling for a lower quality of work for a more reasonable price. In fact, the opposite is true. Cost savings are a massive reason companies shift their accounting processes offshore, with almost all accounting becoming tied with IT for the most outsourced business processes at 37%.

Here are a few reasons why you should hire an offshore accountant:

- The cost of hiring an accountant is low in offshore locations due to the low cost of living and lower labor costs.

- You can access a wider talent pool of qualified accounting professionals than your local one.

- Offshore accountants have worked with diverse client bases and business models and know how to leverage their accounting skills to their advantage.

- Despite popular belief, offshore certified accountants and bookkeepers are more attuned to regulations like GAAP (Generally Accepted Accounting Principles) and legal frameworks and licenses to practice accounting ethically.

- Thanks to their bilingual and multilingual capabilities, they can communicate with a diverse population of people.

- They have exceptional communication skills to quickly collaborate with your team and clarify technical concepts.

- They work harder to maintain integrity because they work in a competitive environment with international clients.

And that’s not all – you can also find specialists who can augment your team with accounting expertise to improve your financial operations. You can hire skilled accounts receivable specialists and accounts payable specialists to collaborate with your in-house accounting teams and boost your cash flow.

Remote Scouts – Your Remote Staffing Partner to Hire an Accountant

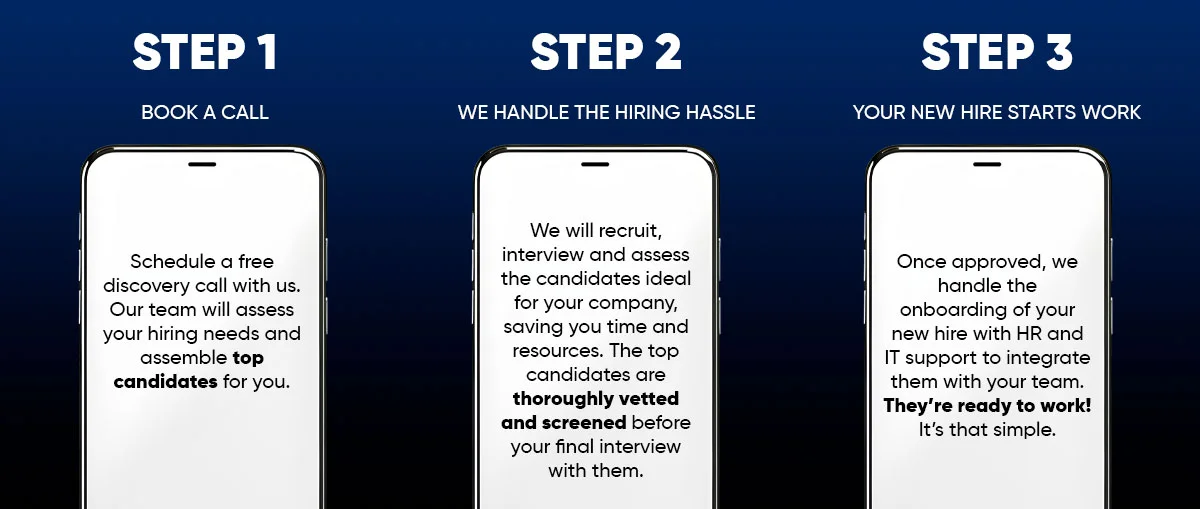

If you are wondering how much does it cost to hire an accountant offshore, you also need to ensure you get the quality of the work you need. With Remote Scouts, you can access a large talent pool of qualified accounting talent at competitive rates. Unlike an expert accountant in the U.S., who will cost you about $100/hour, you can get a skilled and certified accountant at $16/hour through us. Here is how we make that happen.

- We are backed by 13 years of staffing experience, which we have distilled into tailored solutions to resolve your hiring needs.

- Our expertise spans onshore, offshore, and nearshore staffing, so we can hire an offshore accountant, nearshore, or remote accountant to reduce labor costs by 40%.

- When looking for skilled accountants, we access untapped talent pools, leveraging the best talent available in up-and-coming markets to reduce your hiring time by 70%.

- As your Employer of Record, we go beyond hiring to provide HR functions, payroll, and compliance services to integrate and manage your chosen candidate within your company.

- To address your data security concerns, we place your chosen certified accountant in a secure offshore but on-site facility to boost productivity and reduce overhead costs such as office placement, equipment, IT support, and onboarding.

Ready to Get Started? Hire an Accountant in 3 Steps

Industry Leaders Trust our Staffing Solutions