Accountant Experts

Remote Scouts is your ideal source to access remote accountants who can help you elevate your business through insightful and thorough financial management. Finding one reliable person to manage accounting tasks is a challenge for most companies, especially if they are a one-person show. Even if a larger team is working in a company, you need to hire an accountant to streamline all your transactions and record keeping so that your financial structure remains intact and there are fewer discrepancies and errors when managing your finances. Hire a remote accountant who can work from anywhere and provide systemic financial restructuring without depleting any more of your resources. You might think that hiring an accountant may stay the same for your organization, but having a dedicated resource for accounting can transform your cash flow and manage your revenue stream efficaciously.

Trusted by Top Tier Companies

"*" indicates required fields

The Qualities of an Accountant

- Accountants must be meticulous and ensure accurate financial records, calculations, and reports.

- A robust numerical proficiency to perform calculations accurately and efficiently.

- Adherence to ethical standards when maintaining confidential financial matters.

- Precision in handling financial data for reliable decision-making.

- Strong analytical skills to provide insights into financial complexities.

- To ensure compliance, they are well-versed in laws and regulations governing financial reporting and taxation.

- Positive customer relationship management skills to ensure client satisfaction and efficacious customer management.

- Practical organizational skills in documenting and streamlining financial processes.

What Does an Accountant Do?

You might think that a suit and tie crunching numbers diligently is what the ideal accountant should be, but that is now a notion of the past. The skills of an accountant have evolved beyond that now and encompass major financial decision-making that impacts a company in profound ways. Whoever oversees your financial management needs a bird’s eye view of your finances – where the money is going, the channels it is pouring from, and how to regulate, unclog, and increase its flow effectively. An accountant worth their salt will have the accounting skills to leverage technology, broad market knowledge, and a personalized solution-based approach to meet the standards you are looking for. Hire an accountant who knows how to leverage remote accounting to alleviate the pressure from your core team for accounting tasks and take the burden of streamlining your numbers to provide you maximum profits and generate value for your financial well-being. When hiring a virtual accountant who will look after your finances, there are several things they will need to build expertise to take care of your financial health holistically through these virtual accountant services.

Let’s Talk Prices

The cost of hiring a Remote Accountant Expertise is why most companies choose to manage their own Remote Accountant Expertise. But what if you could get a qualified Remote Accountant Expertise at a flat hourly rate, for the full day?

Remote Accounting Services We Offer

A company can only survive with a foresighted guide who can tell them where their financial decisions will lead them. Our offshore accounting services are designed to take your business from where it is right now to new avenues while maintaining your financial health at its maximum through these services position

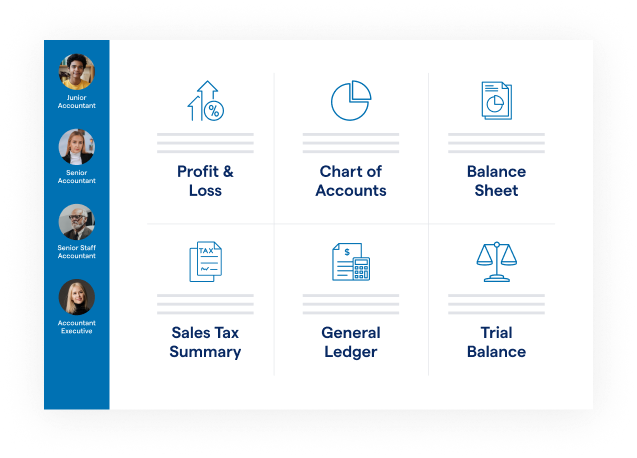

Senior Accountant

A senior accountant must oversee all financial activities, including financial reporting, budgeting, and forecasting. They analyze economic data to identify trends, variances, and areas for improvement. Remote senior accountants also review and reconcile accounts, ensuring accuracy and compliance with accounting standards. Their guidance is pivotal for their team to manage accounting tasks.

Junior Accountant

Working in collaboration with and under the senior accountant, junior accountant duties include assistance with the day-to-day accounting tasks such as data entry, processing invoices, and reconciling accounts. They perform fundamental financial analysis and variance analysis and assist in preparing budgets and forecasts.

Senior Staff Accountant

As they handle a range of responsibilities, senior staff accountants handle more complex accounting tasks such as preparing journal entries, reconciling accounts, and analyzing financial data. They assist in month-end and year-end closing processes and collaborate with the management to develop economic strategies and plans.

Entry-Level Accountant

Usually useful for small businesses, an entry-level staff accountant performs basic accounting tasks such as data entry, processing transactions, and maintaining financial records. They also learn accounting tools and software and assist in preparing financial reports and statements.

Accountant Executive

They usually hold a leadership position within the accounting department. They develop and implement financial strategies to achieve organizational goals. They can also provide strategic financial guidance to senior management and oversee financial reporting and budgeting. They will also manage accounting and meet department objectives.

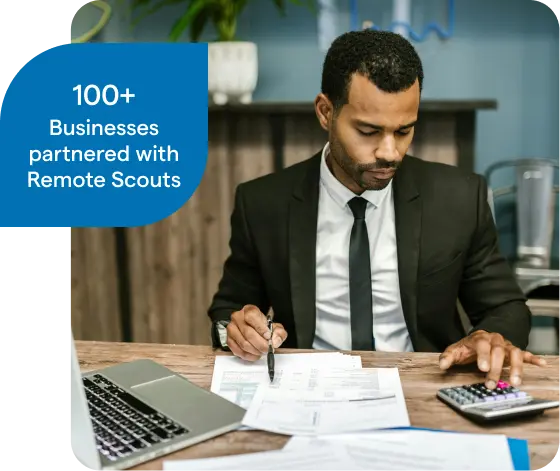

Who can Hire Remote Accountants?

All kinds of huge or tiny businesses need accounting services to run their business correctly and generate profits. With the expertise of skilled accountants keeping an eye on financial strategies, businesses would thrive. So, from large enterprises to self-employed people, accountants are an asset. Some companies can benefit from our remote accountants’ accounting skills.

Accountants for Small Businesses

All kinds of small businesses, whether Etsy sellers, apparel stores, or bakeries, need assistance with bookkeeping, financial reporting, tax compliance, and strategic financial planning. Accountants for businesses and tiny businesses also look after payroll processing and provide financial advisory services.

Accountants for Independent Contractors

Accountants who work for independent contractors and freelancers require accounting services tailored to their unique business structure, tax obligations, and financial planning needs. Accountants for self-employed people and freelancers help with tax deductions, tax planning, record-keeping, and financial management.

Accountants for Tradies

Tradespeople or skilled construction, plumbing, electrical, heating, or landscaping industry workers need specialized accounting services to manage their finances and comply with tax laws. Accountants for these trades must look over the business’s financial health and provide financial counseling to gain profits and generate revenue streams.

Accountants for Nonprofits

Nonprofit organizations often seek accounting services and expertise to manage their finances, maintain compliance with nonprofit regulations, and prepare financial statements. They also help fulfill reporting requirements and track all funds and grants that come into the organization to manage transparency.

Accountants for Tax Return

One of the most common services of an accountant is managing tax returns for individuals and businesses during tax season. Individuals and companies hire tax accountants to seek assistance with tax return preparation, filing, and compliance, including maximizing deductions and minimizing tax liabilities.

Accountants for Artists and Musicians

Musicians, artists, and all sorts of creatives need the services of accountants tailored to their unique income streams and the royalties they gain. They also must take charge of the expenses, including all equipment, materials, and rent needed to sustain their practice and keep track of all expenditures. They oversee tax implications related to their artistic endeavors.

Hire Offshore Accountants to Streamline Finances

Companies that want to avoid investing in a more extensive accounting team and need financial management advice and services can hire offshore accounting staff. Not only is this cost-effective, but it is also helpful for businesses that don’t require regular accounting processes, like self-employed people or individuals who might need more accounting processes around tax filing and financial reporting. Hiring an offshore accountant from Remote Scouts will ensure that your intermittent and seasonal tax preparation business finances are in check without onboarding an entire team. We can find you an ideal offshore accountant who can get your finances in order without detailed onboarding.

Nearshore Accountants for Secure Accounting

Most people will believe hiring someone offshore will cause issues with data security. While that may be a legitimate concern, most offshore accountants adhere to strict compliance and regulations to manage accounting without any breaches or data security issues. But to put your mind at ease, you also can hire nearshore accountants who work within your region or closer to you so they can work on your time and within a close enough range that communication is smooth. Hire nearshore accountants from Remote Scouts who will be cost-effective for you and a perfect match for small businesses that cannot invest in larger accounting teams. Reap all the benefits of professional accountants without worrying about in-house integration.

Frequently Asked Questions

How to hire an accountant?

You need to follow these steps to hire an accountant:

- You need to assess your accounting needs and determine the services you require.

- Then, research and identify potential accountants and accounting firms with the relevant experience and expertise you require.

- Review their qualifications and credentials to fit your needs and determine if they are the right choice.

- Schedule consultations with prospective accountants to discuss your needs, assess compatibility, and inquire about their rates and pricing.

- Select the accountant and firm that best meets your requirements and negotiate terms for engagement.

What does an accountant do for you?

Accountants provide various services, including maintaining accurate financial records and preparing financial statements and reports. They also assist with tax planning and compliance. They can conduct economic analysis and provide insights on improving financial management. They can also offer strategic financial advice and support budgeting and forecasting efforts. Their auditing efforts also help keep all transactions in check and ensure the company gets the maximum returns for their work.

How do you find an accountant for a small business?

To find an accountant who can benefit a small business, you must ask for referrals from fellow business owners, colleagues, or industry associates. You should search online directories and platforms specializing in accounting services like Remote Scouts, where you can check professional accounting associations and certifications for qualified practitioners. And you can also attend networking events or seminars where you can meet and connect with accountants.

When to hire an accountant?

It would help if you considered hiring an accountant when your business is growing, and you need assistance with financial management. It would help if you also considered it when you lack the time and expertise to handle accounting tasks effectively. If you are facing complex tax issues or regulatory compliance requirements, it would be an excellent time to hire an accountant. If you’re planning significant financial decisions and business expansions, you need an accountant within your organization to guide you in handling your finances during these critical changes.