The debt collection business is not for the weak-hearted, especially if there are thousands of dollars tied up in unpaid invoices and you need capable and resilient people to help you retrieve them. When you decide to hire a debt collector, they must match the industry knowledge and people skills required to collect your debt effectively. The global skills shortage also affects debt collection, with a limited supply of skilled debt collectors against constant demand. How do you ensure you find the right one? Here are 5 things to consider before you hire a debt collector.

What Can A Debt Collector Do?

Before you begin your search, you must clarify your business needs and what a debt collector can do to boost your cash flow and replenish your bottom line.

- Ideally, a debt collector should be able to improve your collection business by developing recovery strategies that suit your business.

- They can provide their expertise to help free your internal staff to focus on their core competencies and operations.

- They can ensure timely debt collection, increasing your cash flow and enabling you to invest in new projects and business growth.

- By minimizing bad debt, your debt collectors help you maintain financial stability and sustain your books without making significant organizational changes to meet budget requirements.

- Trained debt collectors can help improve your company’s reputation and develop positive customer relationships to keep future collaboration opportunities open.

These requirements seem reasonable enough, but why are 27% of the complaints received by CFPB about debt collection? Various factors make up a competent and successful debt collector; a large sum doesn’t check those boxes. So, before you hire a debt collector, consider these essential factors.

Check These 5 Things When You Hire a Debt Collector

Ethical Alignment

One of the most critical aspects of collections is knowing the rules and staying compliant with industry requirements. Debt collectors must conduct themselves ethically to avoid penalties and follow regulations like the FDCPA (Fair Debt Collection Practices Act) to protect consumers from unjust and abusive behavior.

When you hire a debt collector, consider their ethical approach towards consumers. Look for candidates who prioritize respectful and just treatment of consumers, even in particularly challenging situations. According to Debt.com, 50% of consumers reported that collectors threatened or intimidated them into paying a debt.

A trained and professional debt collector should never resort to violent, aggressive, or illegal behavior to recover debt. Integrity and empathy are important factors in the healthcare industry, for example. A medical debt collector must empathize with patients and reduce their financial stress with tailored payment solutions to help them recover their debt without being bullied or harassed.

Technical Proficiency

With the rate at which the finance world is growing, it is imperative that debt collectors upskill themselves to master technology and modern tools. They need to be up to date with the latest software that can help them optimize the collection process and ensure data security. You need innovative people who are well-versed in predictive analysis, automation, and AI-powered systems to manage your collection processes as efficiently as possible.

Hire a debt collector with technical experience and adaptability to learn new tools as they come. Debt collection is no different from any other business regarding technological advancements. Consumers expect innovative solutions to ease their debt recovery process and require collection agencies to provide more self-service alternatives. You must hire debt collectors who can adapt automation and AI to develop intelligent debt collection strategies.

Scalability of Services

The growing need for skilled talent has posed a significant challenge to businesses everywhere, and debt collection is no exception. Despite the ever-increasing implementation of automated communication and machine learning, 79% of consumers still prefer to talk to real people instead of communicating via chatbots or emails.

Consider looking for debt collectors who are willing to commit to the strenuous collection process but can also increase their skills to handle your growing collection needs. Rather than sourcing local collection talent with limited expertise within the U.S., widen your search and hire debt collectors from remote and offshore locations. These professionals can handle diverse borrower populations and varying debt volumes in government debt, public fines and civil debt disputes. They can scale their services up and down according to your collection needs without onboarding or downsizing hassles.

Hire a Government Collection Specialist

Focus on Customer Experience

As mentioned, debt collection is a people-centric business, where positive consumer interactions yield faster results than elaborate technical strategies. Most debt collection agencies earn a bad reputation because their collectors adopt aggressive tactics to approach consumers, leaving them more vulnerable and less likely to cooperate. In fact, in the recent Consumer Experiences with Debt Collection survey, consumers reported more positive interactions with creditors than debt collectors across various dimensions.

Consumers face specific challenges with debt due to the high volume and amount of debt they must repay, especially in sectors like retail and e-commerce. Retail debt collectors have the expertise to encourage timely payments, offer incentives to customers, and resolve payment disputes amicably.

Industry-specific Experience

One of the most common challenges faced by collection agencies is finding qualified debt collectors who understand the nuances of their industry. Most creditors struggle to handle collections internally because their staff is unfamiliar with industry requirements or feels uncomfortable handling the collection stress. Hiring the expertise of a specialized debt collector ensures businesses can allow their internal staff to focus on core competencies.

You must hire a debt collector with industry-specific expertise, so they understand the regulations and unique borrower challenges related to your industry. If you are in the education sector, you need solution-oriented collectors with extensive knowledge of student loan structures to devise effective collection strategies for student borrowers.

How Much Does It Cost To Hire A Debt Collector?

Now that you know which factors help you hire a debt collector suited to your business needs, you need to tackle the other impending challenge—the cost of hiring a debt collector. Internal hiring is not every business’s first choice, but the added expense of assembling a collection team pushes them to utilize their team for collections as well.

The average salary for a debt collector is $23 in the U.S., with rates ranging from $7.21 to $37, depending on the industry and size of the business. Small and medium-sized enterprises often handle their collections internally because they can’t afford debt collector salaries on top of their other business expenses. A company that needs to recover delinquent payments would probably not be able to pay collection specialists to handle debt recovery.

But there is a suitable and cost-effective workaround – offshore and nearshore debt collectors. Where you would typically incur an hourly cost as high as $23 – $37 for a collector, you can get a specialized debt collector for as low as $16; if you know where to look.

Watch: Why Does Pakistan Have the Best Debt Collectors?

Partner with Remote Scouts to Hire a Debt Collector

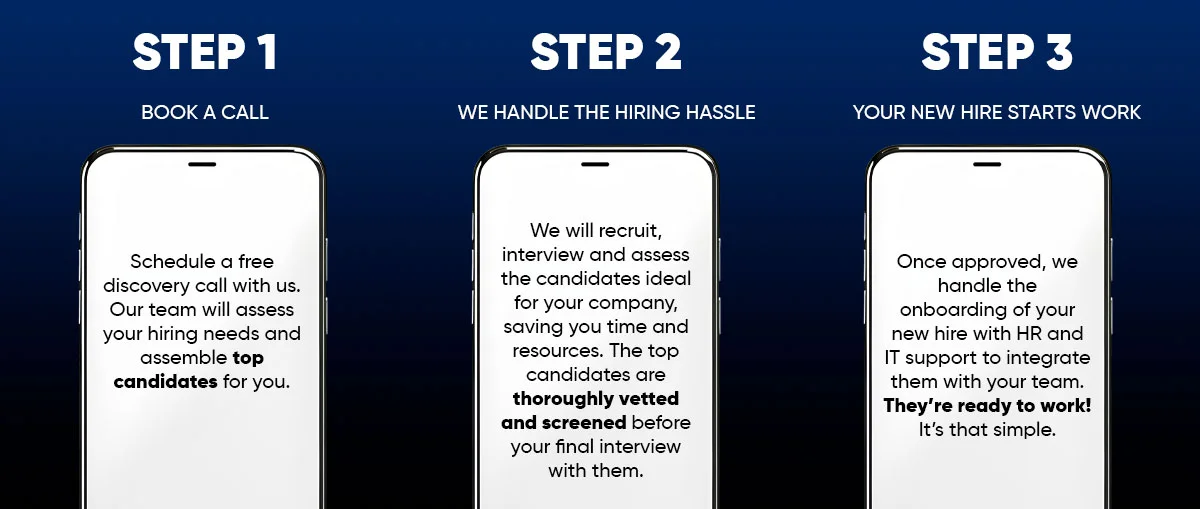

The search for specialized debt collectors ends here – we are your ideal Employer of Record that can recruit, screen, and place specialized debt collectors with you. Our extensive talent pool has access to trained debt collectors ready to join your company at the drop of a hat. We source specialized debt collectors to handle your high-stakes collection processes and reduce bad debt to improve your cash flow.

Here is why we can hire a debt collector best suited to your needs:

- We are backed by 13 years of staffing experience, which we have distilled into tailored solutions to resolve your hiring needs.

- We leverage the experience of our parent company Cedar Financial, a frontrunner in the collection business for the last 31 years. Our debt collector talent pool is especially trained by the Cedar University training program that instills compliance, problem-solving and a people-focused to expertly handle debt recovery.

- Our expertise spans onshore, offshore, and nearshore staffing, so we can hire a debt collector offshore or nearshore to reduce labor costs by 40%.

- As your Employer of Record, we go beyond hiring to provide HR functions, payroll, and compliance services to integrate and manage your chosen candidate within your company.

- To address your data security concerns, we place your chosen debt collector in a secure offshore but on-site facility guided by SOC II Type II compliance certification to safeguard your sensitive data and conduct collections with complete professionalism and integrity.

Ready to Start? Hire a Debt Collector in 3 Steps

Industry Leaders trust our Staffing Solutions